If Senate Bill 344 passes, it will allow an 11-day tax holiday every October for guns, ammunition and related accessories.

Republican Senator Jason Anavitarte sponsored the bill to promote hunting to help control the deer population in Georgia. Democratic District 82 State Representative Scott Holcomb believes that this reasoning lacks basis.

“It’s doubtful [that the tax holiday will help control the deer population],” Holcomb said. “Our state doesn’t have a shortage of hunters, and I’ve seen no evidence to support the argument that absent this tax credit people will not hunt. Instead, this is a tax giveaway.”

The tax holiday lasts from the second Friday of October through the fourth Monday of October each year. This period is right before the start of deer hunting season and right before election season. Democratic State Representative of District 98 Marvin Lim is worried about how the bill could be used for political purposes.

“We know that firearms are touchy and a controversial issue that gets a lot of people interested,” Lim said. “If this were to pass, politicians could say ‘Hey we passed this bill that allows you to buy firearms without a sales tax every October.’ I think this will be used for those political purposes. In the end, it is just a very broad bill that is not accomplishing a narrower purpose.”

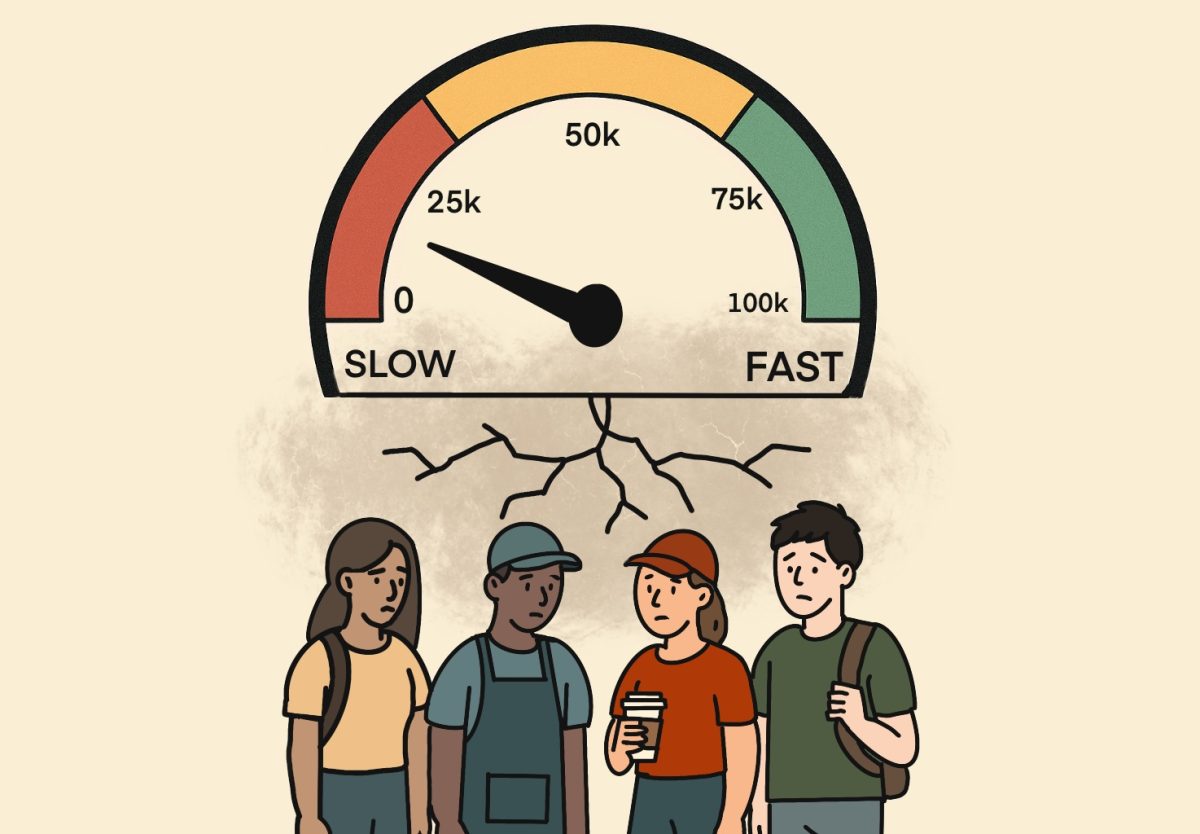

The bill passed in the Senate on Tuesday, Feb. 6 with a 30-22 vote. If it passes through the House of Representatives, it will be implemented until June 2029. Lim believes this bill will lead to more firearms being owned.

“The bill is problematic, and it will likely lead to the proliferation of more firearms,” Lim said. “It is an interesting kind of way to incentivize gun ownership. I think it will make it easier for people to do so. Part of the bill provides for a sales tax holiday on gun safes and accessories that would help one own a gun more safely. That part of the bill is good, but the other parts of the bill would lead to more firearms in general being distributed.”

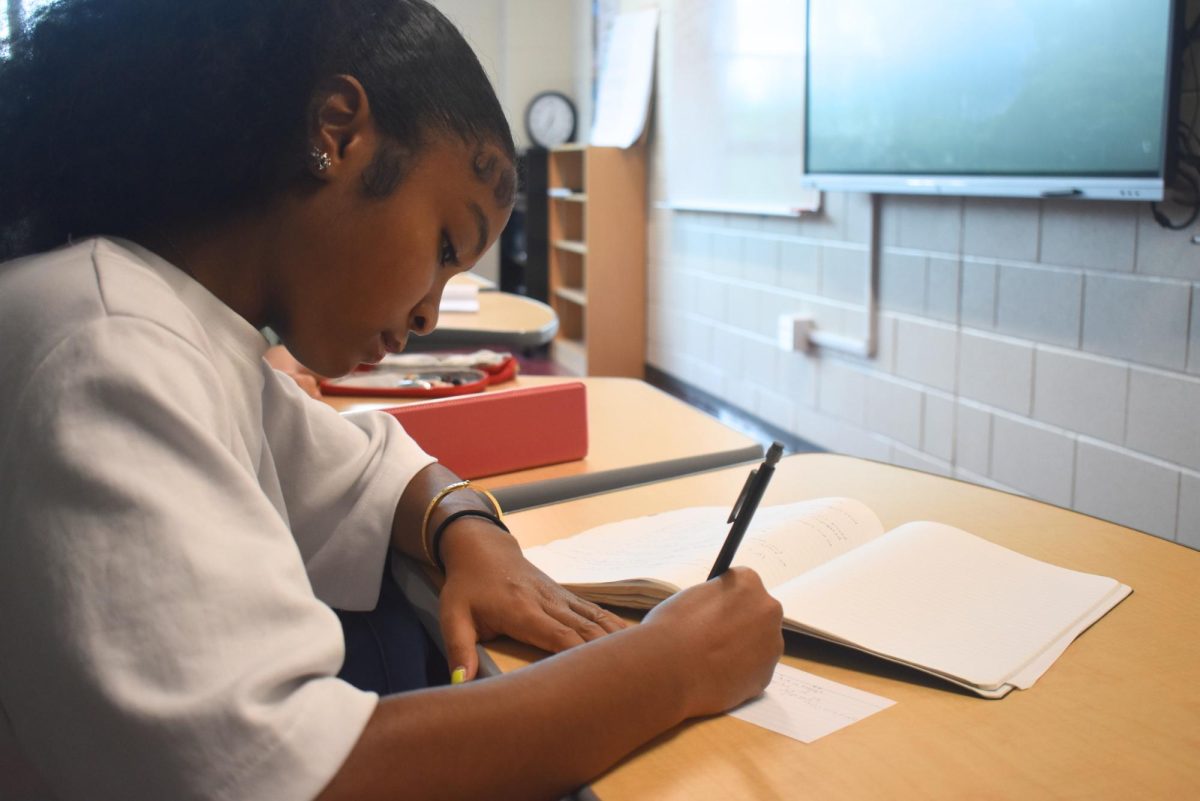

Holcomb is worried about the negative effects of a gun tax subsidy on gun violence across Georgia.

“[The impact of a tax holiday on gun violence] would likely be difficult to measure, but it is highly unlikely that a tax subsidy would reduce gun violence,” Holcomb said. “This policy will not reduce gun violence in schools. There are steps that can be taken to reduce gun violence, but a tax subsidy is not one of them.”

State Representatives Mark Newton, Scott Hilton, Robert Dickey and Bill Hitchens are proposing House Bill 971 to focus on a subsidy for gun safety devices, establishing a $300 tax credit for this purpose.

“In the house, we just passed a bill that was a tax credit,” Lim said. “It was a similar idea around savings for gun safes. That is something that we should be incentivizing, whether through a sales tax holiday, a tax credit, or other things to reduce the costs of having gun safes. That would be great. Again, the problem is including that in a bill that makes it easier to access guns in general.”

Midtown ‘March For Our Lives’ president Delia Schroeder believes that this tax holiday could potentially raise the possibility of shootings.

“The best way to minimize shootings is the opposite of making them cheaper,” Schroeder said. “It is raising prices, background checks, and addressing the [United States] mental health crisis. We should be making guns less accessible, not more.”

Lim said the main problem of Bill 344 is that it makes buying guns an 11-day event, and the money given won’t convince people to buy guns.

“[The bill] is only likely to increase gun violence in Georgia,” Lim said. “On the one hand, the sales tax savings aren’t that much in dollar amounts: around $20. It isn’t the amount of savings that would break the bank. However, just the idea of a sales tax holiday and knowing that [11] days in October there’s a sales tax holiday, behaviorally, that will encourage people to buy firearms on that particular day. That will encourage it because that creates a kind of an event.”