Throughout December, many high school seniors and college students anxiously awaited the release of the Free Application for Federal Student Aid — an application necessary for determining federal financial aid eligibility. Typically, the application is available on Oct. 1, however, the 2024 – 2025 application round was shakily released three months later, creating mass confusion and problems for both universities and students.

After Congress passed the FAFSA Simplification Act, the processes and systems FAFSA used to determine aid were greatly changed, resulting in delays. Understandably, a brand-new system might have flaws, however, the application process for this round has been unacceptable and some of the new changes must be amended.

The purpose of the FAFSA Simplification Act was to improve the application process and increase fund eligibility for students and parents. One major change is the replacement of the Expected Family Contribution with the Student Aid Index. The new analysis formula will allow a minimum student index to be -$1550, ensuring that an applicant’s financial needs are more accurately determined. The changed criteria for Federal Pell Grants will also increase the eligibility for many students.

While both of these changes are positive, there are also drawbacks — one is the removal of sibling discounts. Unlike the Expected Family Contribution, the new analysis formula will not take into account if other family members are attending college. Families with multiple students enrolled will receive significantly less aid than before the FAFSA Simplification Act, a change that must be reconsidered.

Even more concerning, however, is that the analysis formula used has not been updated for inflation, a mistake that will affect every student who applies for financial aid through FAFSA.

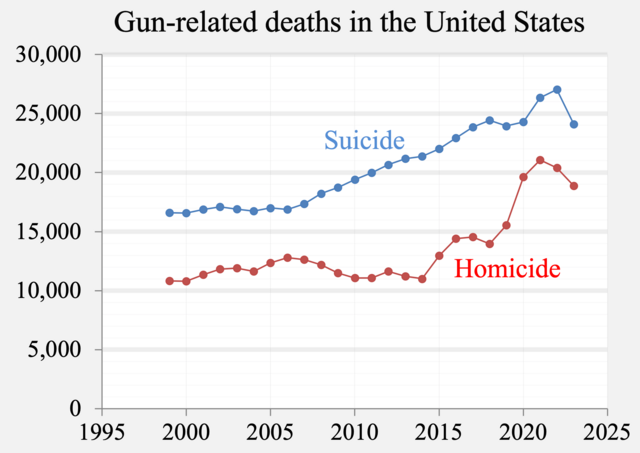

Throughout the pandemic, federal initiatives, supply chain disruptions and strong consumer and business demand caused high levels of inflation. Peaking at roughly 9% in 2022, inflation has declined but is nowhere near the early pandemic levels. According to the Washington Post, the current formula was supposed to use the inflation rate from April of 2023 but instead used the inflation rate from April of 2020.

According to the U.S. Bureau of Labor Statistics, in April 2020 the inflation rate was 0.3%, while in December 2023 the rate was 3.4%, a stark difference. To put that into perspective, $10,000 in April 2020 is the equivalent of $11,964.09 in December 2023.

Because of this error, students will not receive the full amount of aid they deserve. Families will appear to have more money and will qualify for less aid when in reality, this is only because of inflation. Additionally, the price of college tuition and fees is rising. From February 2020 to February 2023 the price of tuition rose by 4.7% and the cost of business and technical school rose by 5.2%.

This mistake could cost students and families thousands of dollars, and fixing it could result in even more delays. Financial aid and the cost of attendance are vital parts of college and students deserve to have time to think about life-altering college decisions. Additionally, college institutions deserve to have time to work on financial aid. Because of the FAFSA delays, neither students nor colleges have had either.

Nothing new is expected to work perfectly, but some of these errors can be detrimental to students and families and unfair to colleges. In the future, inflation levels must be corrected, delays must be reduced, and sibling discounts should be reconsidered.