Anger against Robinhood shifts blame from Wall Street

Robinhood has made investing accessible by offering commission-free trades. This has helped amateur investors and weakened Wall Street’s control.

February 16, 2021

From “Remember the Titans” to “Slumdog Millionaire,” underdog stories have long captivated audiences.

In 1976, people flocked to theaters across the country to watch arguably the greatest underdog movie of all time, “Rocky.” In the movie, Rocky Balboa, a working-class boxer from Philadelphia, fights the heavyweight world champion. The highest-grossing movie of 1976 that kicked off a series of six movies, “Rocky” appealed to audiences because they could relate to Rocky, who, despite losing the fight, beat the odds and came out standing at the end. His story inspired many others to fight against their own seemingly insurmountable obstacles.

However, unlike in movies, real-life underdog stories are rarely clean-cut, and, in our desire to support the hero, we often craft false villains.

When the trading app Robinhood, an app designed to aid amateur investors by allowing them to invest without paying a commission, decided to limit trades of GameStop and prevent their users from participating in the large spike, it seemed like they were contradicting their very name by supporting the ‘haves’ over the ‘have nots’. Many of their users were trying to participate in the fight against Wall Street by using their large numbers to influence the stock market in their favor and against the interests of the hedge funds. However, blaming Robinhood ignores the real forces at work and the actual villains of the story, the investors and groups that control the stock market.

On Jan. 22, members of r/wallstreetbets, a forum about stock trading on the website Reddit, caused a “short squeeze” of GameStop (NYSE: GME) along with other stocks such as AMC Entertainment (NYSE: AMC) and Bed Bath and Beyond (NASDAQ: BBBY). Previously, analysts had predicted that each of these stocks would decrease in value and Wall Street hedge funds and traders had begun to “short” them. In a short position, investors bet against a stock to make money when the value decreases. Often, they do so by borrowing stocks and then selling them. Just as a large number of purchases of shares can increase the price, enough sales (including shorts) can cause the price to drop drastically.

In response, amateur traders on r/wallstreetbets started purchasing GameStop shares, causing the stock price to jump hundreds of percentage points in days, enabling the short squeeze, which happens when a stock jumps in response to short selling. This meant that the groups that had shorted the stocks had to borrow money and purchase the stocks instead of selling to minimize their losses, which was their original intention. These purchases further increased the price of the stocks. Some amateur traders participated in the squeeze in retaliation to the 2008 financial crisis when Wall Street passed the majority of the consequences of their mistakes to the middle and lower classes. Others simply wanted to make money or join the movement.

Many of the investors in GameStop used the platform Robinhood to purchase GME and other stocks. Unlike most platforms, which make money by adding a fee to each trade, Robinhood doesn’t take a commission from investors. Robinhood Securities, their clearing broker (the group that actually buys the stock from the company before passing it off to the investor) gets competitive prices from market makers, and Robinhood keeps the difference as revenue. This allows them to make money from sources other than traders, which keeps trading accessible for those who don’t want to pay extra to invest.

On Jan. 28, Robinhood limited the trade of GameStop to one share per investor and placed restrictions on 50 other companies like AMC, Nokia, and Bed Bath and Beyond, whose stocks were also part of the short squeeze. This decision was met with immediate backlash from the public, who assumed that Robinhood was trying to help the hedge funds at the expense of the “little guys,” whom their platform was intended to uplift.

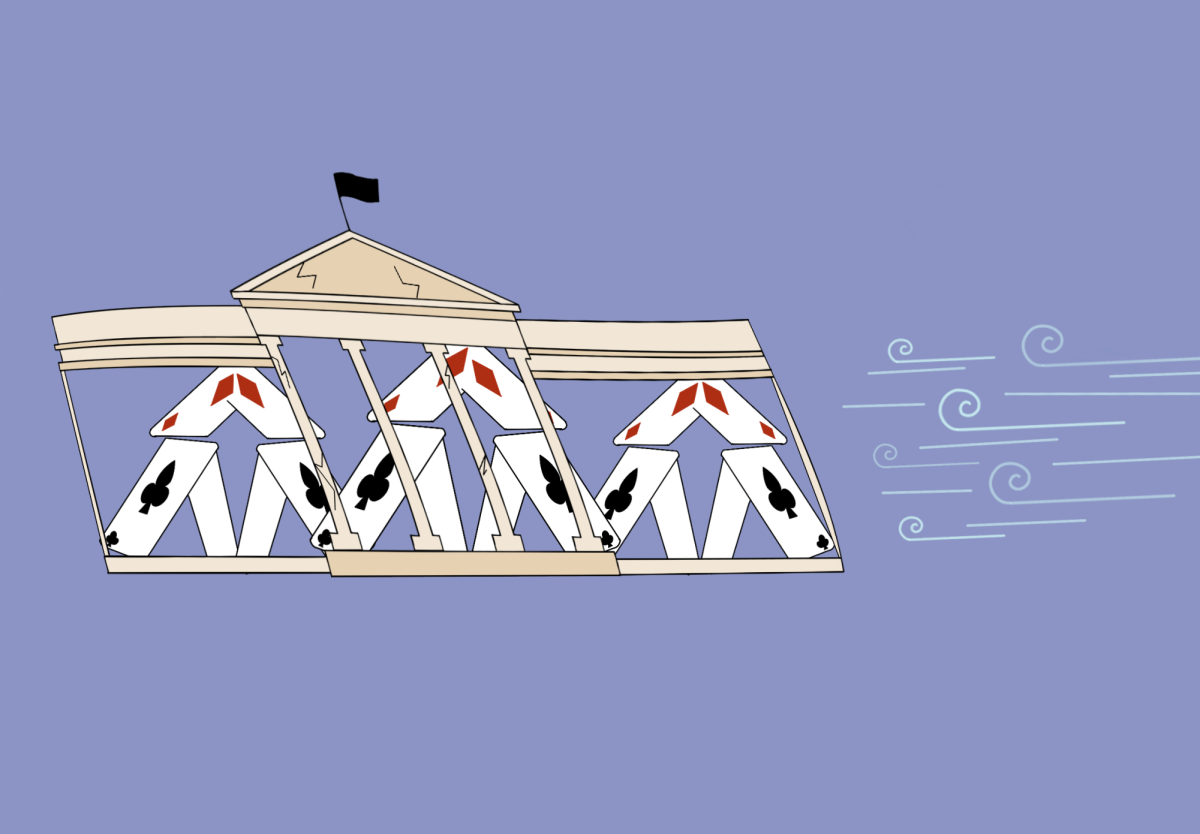

However, Robinhood’s decision to prevent trading was forced by government regulations. When someone tries to buy shares of a company, it takes up to two days for that trade to be processed by the National Securities and Clearing Commission (NSCC). During that time, Robinhood and other platforms have to put up the money to cover the trade and pay the NSCC. Due to the large increase in trading by members of r/wallstreetbets, Robinhood received a 3 billion dollar request from the NSCC. Because they did not have the funds to cover the trades, though, and the volatility of the stock had already made any loan extremely risky, Robinhood was forced to regulate the trading of the stocks so that their bill did not increase even more.

Although Robinhood didn’t respond to the situation perfectly and perhaps should have explained their decision sooner, their actions are only a response to a much larger problem. The problems begin with the financial elite who, shielded by their bank accounts and their positions, can escape relatively unharmed while the public pays the price.

During the early 2000s, mistakes by lenders and other Wall Street groups created a housing bubble and made the entire market extremely unstable, which eventually led to the 2008 financial crisis. Although the banks did suffer consequences, many of them were able to bounce back much more quickly since they had the funds to weather the crisis. On the other hand, many peoples’ life savings were in the housing market (and other parts of the market), and the crisis led to financial ruin for them.

The Wall Street elite have also made it very difficult for regular people to participate in trading and have protected themselves, creating a feedback loop where they always profit in the long term. During the GameStop bubble, they used all of the resources at their disposal to try and regain control of the market and bring the market back to normal. Instead of turning against Robinhood, a platform that has made investing accessible to millions, amateur traders should direct their anger towards the root cause of the problem. The backlash against Robinhood only diverts attention away from Wall Street and, although we love rooting for an underdog, we cannot forget who they are really up against.