The One Big Beautiful Bill Act (OBBBA), passed by Congress in July, 2025, made significant amendments to the Higher Education Act of 1965. Many of these changes will be implemented starting July 1, 2026.

One of the major changes that will be implemented across the United States is the altering and capping of federal student loans. Depending on the type of loan and level of education, the annual caps vary from $20,000 to $50,000, while the lifetime caps vary from $65,000 to $200,000. However, the total lifetime limit is $257,500.

“I think the intentions of [the student loan capping], or at least the way they are being presented are good,” senior Reuben Mackler said. “However, it’s unfortunate that some really bright students won’t be able to pursue the college or university of their choice.”

One of the OBBBA’s main goals is to prevent students in differing academic and scholarly levels from having less debt when graduating. Mackler is worried the bill may have adverse effects.

“In a way, I think the possibility of the bill holding students back from attending certain schools may actually widen the income inequality gap,” Mackler said. “Hypothetically speaking, you may have a student coming from immense wealth that can go to any school they could ever want, while a student of equal or greater worth in the eyes of admissions has much fewer means of covering the cost. This issue is something that the US is already stuck in the cycle of, but I’m not sure if this is something that the bill will in turn help to resolve.”

According to the Princeton Review, the average cost of medical school is upwards of $200,000 in total and in some cases exceeds the overall lifetime limit. For senior Lola Lignugaris who dreams of becoming a doctor, this raises concern.

“This new cap on student loans might affect my ability to pay for college by causing a greater reliance on private loans,” Lignugaris said. “I feel like for a lot of students, they probably have at least some money saved for college, typically saved for them by their parents. However, when it comes to grad school that’s where I get worried. Private loans have high interest rates and grad school can be more expensive than regular undergrad, especially if you’re considering something like medical school.”

Not only are students navigating these new changes, schools are also having to learn their way around the policies. In addition to the caps, the Trump Administration is pulling federal funding for many universities, including the Ivy Leagues. The new immigration laws are making the supply of international students dwindle, forcing schools nation-wide to reorganize and regroup.

“This policy has made me re-think certain parts of my college application process, such as early decision,” Lignugaris said. “It is well known that when you make an early decision somewhere, you are much less likely to get any money than if you were to accept a regular decision. Also, with these caps, schools are being put in a bind as well. Money is getting tighter, which makes me rethink if making an early decision to go to a school is a good choice.”

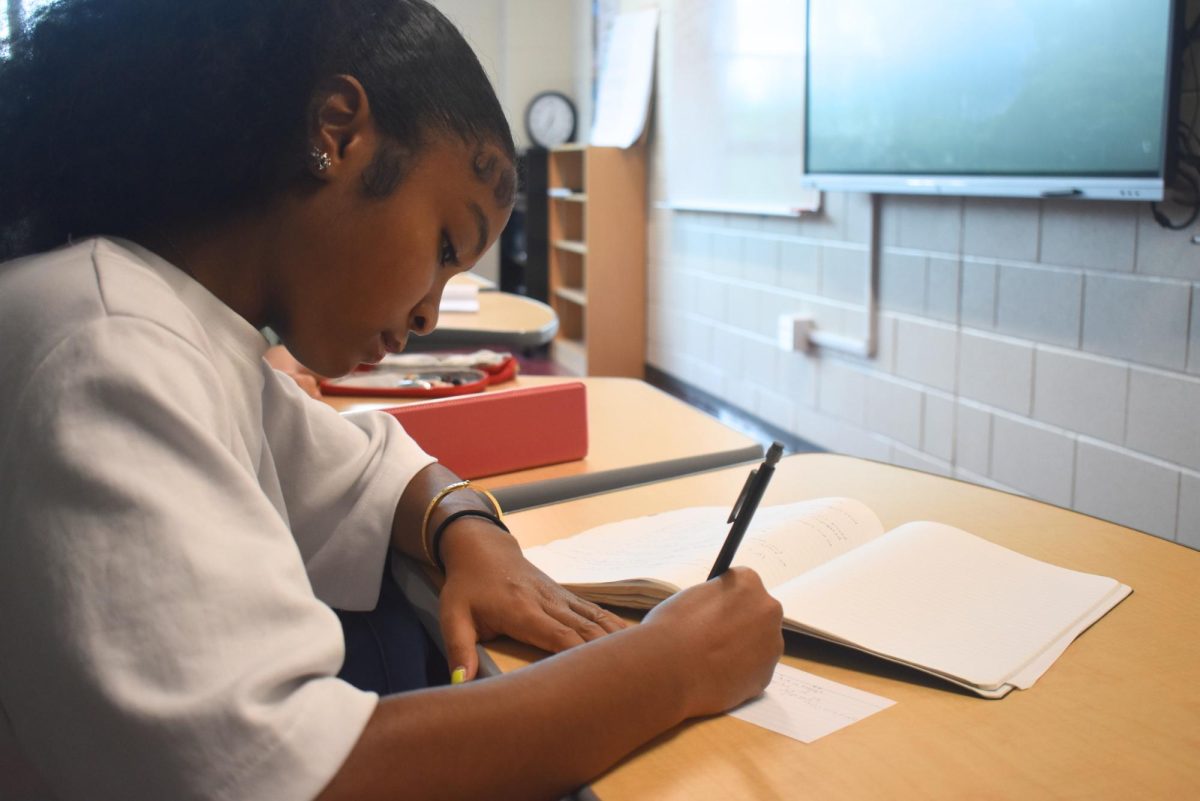

Some of the most present observers in the process of applying to schools are teachers. Gifted and Talented program head Kelly Wren, said she has witnessed all of the ups and downs.

“My main concern and biggest fear is that this will limit students by lessening the opportunities they could have, which would hurt the nation as a whole,” Wren said. “I’ve seen students, who are the first generation in their family to go to college, struggle to find the finances to go.”

According to First Generation Forward, approximately 8.2 million university students are first generation, or about 54%. However, only 24% of those students graduate.

“From what I can tell, this may really crush the chances that some students have at achieving their goals and building the life they want for themselves,” Wren said. “The absolute, most important thing about all of this is the future of our country and that relies on these students.”